What is the Quick Ratio?

The quick ratio, also called acid test, is a liquidity ratio that shows to what extent a company can cover its current liabilities with very liquid assets.

How to Calculate the Quick Ratio

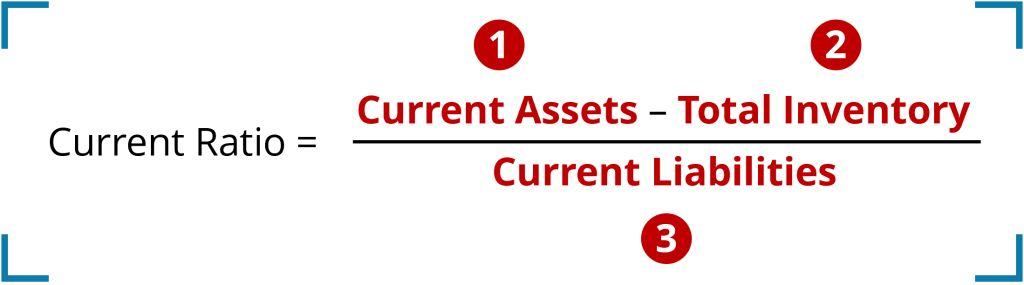

The quick ratio is calculated by subtracting inventory from current assets, and dividing the resulting figure by current liabilities.

All three are found on a company’s balance sheet.

How to Interpret the Quick Ratio

The quick ratio is similar to the current ratio in the sense that both are liquidity ratios and highlight how well a company can cover its current liabilities with current assets.

Whereas the current ratio uses the entire current assets in the numerator, the quick ratio leaves out the inventory and focuses on very liquid assets. The point of leaving the inventory out of the equation is that inventory has cash tied up, and the company would first need to sell the inventory before it can access the cash again to pay off any current liabilities.

This means that a company with a current ratio of >1 might be able to cover all its current liabilities with current assets. However, if a big portion of the current assets are tied up in inventory, and the company is in a bind, it might have to get additional financing to cover its current liabilities, possibly at unfavorable conditions.

In conclusion, a company with a quick ratio above 1 is able to cover all its current liabilities with very liquid current assets, i.e. without factoring in inventory.