What is an Earnings Yield?

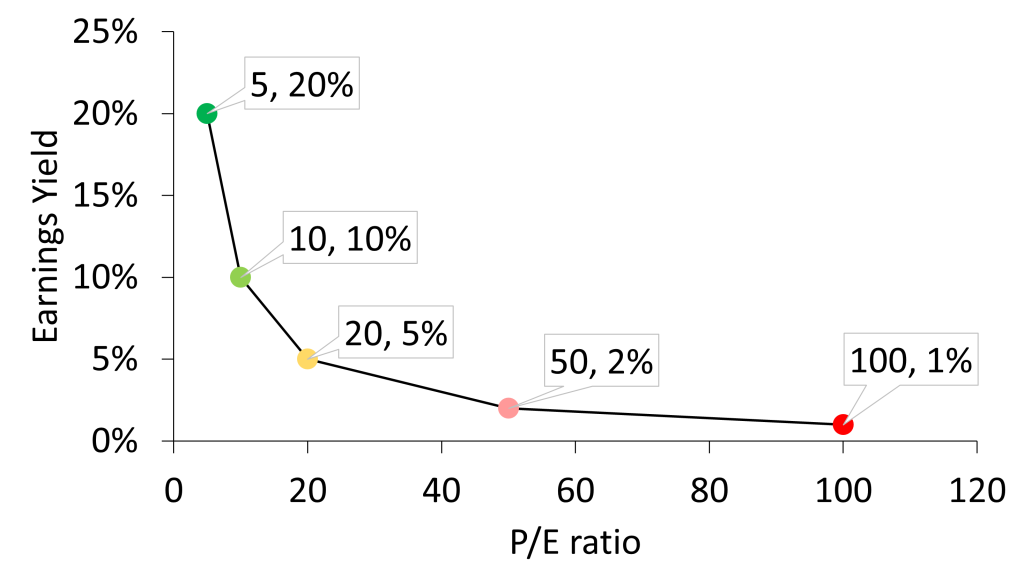

The earnings yield is a valuation ratio that compares a company’s current share price earnings with its earnings per share. It is the inverse of the price-earnings (P/E) ratio.

How to Calculate the Earnings Yield

The earnings yield can be calculated in two ways.

The first way is to divide 1 by the P/E ratio.

The second way is to divide the earnings per share (EPS) by the current share price.

How to Interpret the Earnings Yield

A high earnings yield such as 20% suggests that shares are cheap, since the company’s share price is low compared to the earnings. This corresponds to a low P/E ratio of 5.

A low earnings yield, for example 1%, which corresponds to a P/E ratio of 100, suggests that shares are expensive.

Limitations of the Earnings Yield

Using the earnings yield as a relative valuation measure has its limitations, which need to be considered when evaluating whether a company’s shares are cheap or not.

1. A company must have positive earnings.

If a company shows a loss, the earnings yield cannot be calculated. This makes the earnings yield more useful for established, more mature businesses that are profitable, and not as useful for younger companies that haven’t yet established profitability. For younger companies, the price-sales (P/S) ratio is more useful as a relative valuation measure.

2. Earnings yield may be overstating cheapness.

While a high earnings yield suggests that a stock is cheap, it is not necessarily a reason to buy the stock. The market might be factoring in expectations of future poor performance of the stock, justifying the low price. On the other hand, the stock might actually be cheap due to mispricing of the market.

3. Earnings yield may be understating cheapness.

A company with a low earnings yield suggests that the stock is expensive. A company might achieve low earnings by investing heavily into expenses that build out an economic moat to ensure profitability in the future, possibly justifying the higher price.

For these reasons, a more suitable measure would be the PEG ratio, which factors in not only the P/E ratio, but the earnings growth rate.