What is the Price-Earnings (P/E) Ratio?

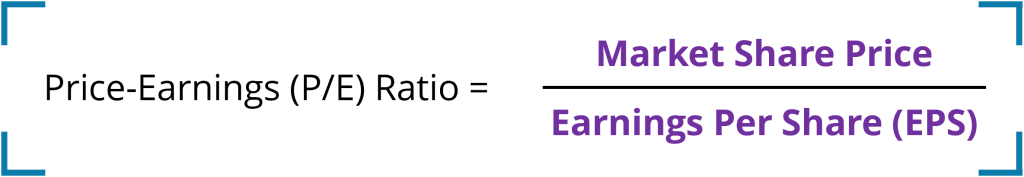

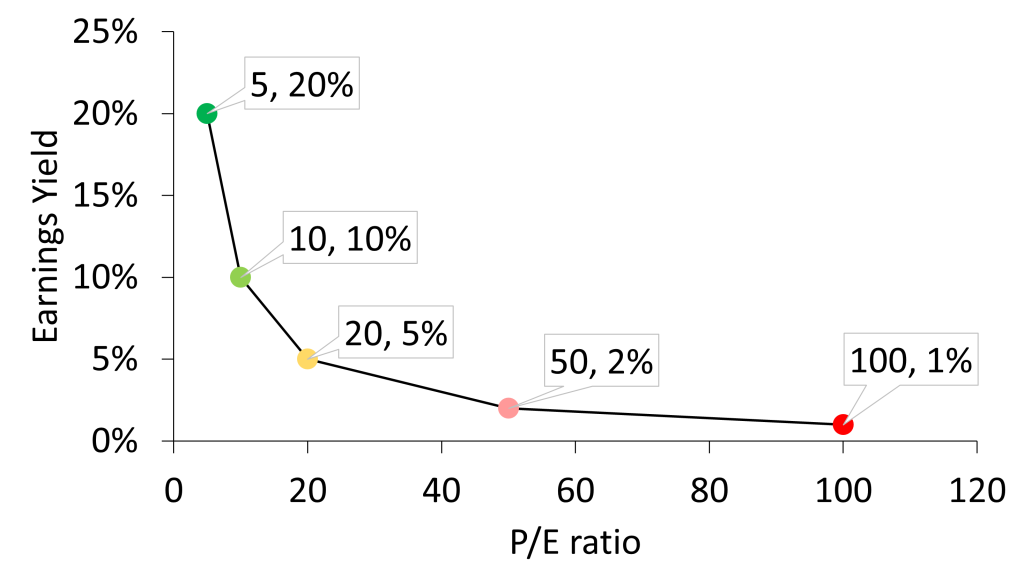

The price-earnings (P/E) ratio is a valuation ratio that compares a company’s share price with its earnings. It is the inverse of the earnings yield.

How to Calculate the P/E Ratio

The P/E ratio is calculated by dividing the current market share price by the earnings per share (EPS) of the current reporting period.

A publicly traded company’s market share price is readily found online, and the earnings per share (EPS) can either be calculated, or found on a company’s income statement.

How to Interpret the P/E Ratio

A low P/E ratio such as 5, which corresponds to an earnings yield of 20%, suggests that a company’s shares are cheap.

A high P/E ratio such as 100, which corresponds to an earnings yield of 1%, suggests that shares are expensive.

Limitations of the P/E Ratio

The price-earnings (P/E) ratio as a relative valuation measure has certain limitations which need to be considered when evaluating whether a company’s shares are cheap or not.

1. A company must have positive earnings.

If a company shows a loss, the P/E ratio cannot be calculated. This makes the P/E more useful for established, more mature businesses that are profitable, and not as useful for younger companies that haven’t established profitability yet. For younger companies, the price-sales (P/S) ratio is more useful as a relative valuation measure.

2. The P/E ratio may be overstating cheapness.

While a low P/E ratio suggests that a stock is cheap, it is not necessarily a reason to buy the stock. The market might be factoring in expectations of future poor performance of the stock, justifying the low price. On the other hand, the stock might actually be cheap due to mispricing of the market.

3. The P/E ratio may be understating cheapness.

A company with a high P/E ratio suggests that the stock is expensive. A company might achieve low earnings by investing heavily into expenses that build out an economic moat to ensure profitability in the future, possibly justifying the higher price.

For these reasons, a more suitable measure would be the PEG ratio, which factors in not only the P/E ratio, but the earnings growth rate.