What is the Compound Annual Growth Rate (CAGR)?

The compound annual growth rate, or CAGR, is the average annual growth rate for any value or amount that grows over time, such as the rate of return of a stock or entire portfolio, or the growth rate of sales or earnings. The calculation factors in reinvestment and therefore compounding.

CAGR is a widely accepted way of smoothing out investment returns which allows comparing the performances of different assets or asset classes with each other, let’s say of stocks with bonds, or the portfolio performances of different fund managers.

Because CAGR normalizes different time horizons to an annualized basis, it allows comparing investment returns resulting from different time frames with each other.

How to Calculate the Compound Annual Growth Rate (CAGR)

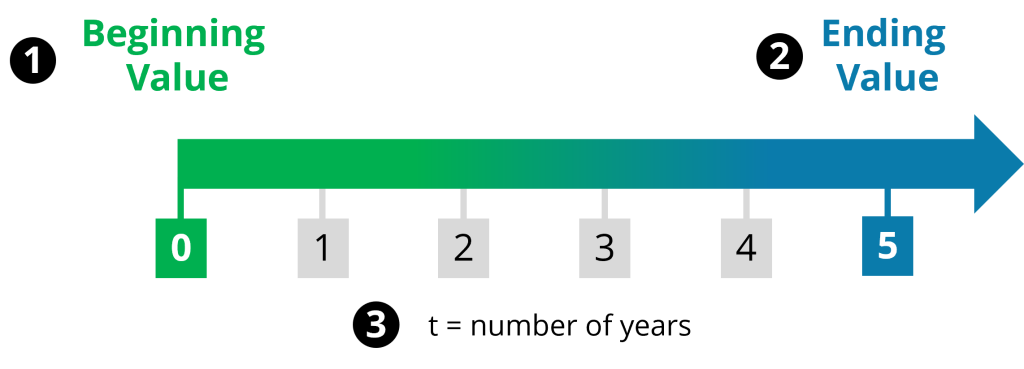

To calculate a compound annual growth rate, we need to know the values for three variables:

- Beginning Value (VBegin)

- Ending Value (VEnd)

- Number of years (t)

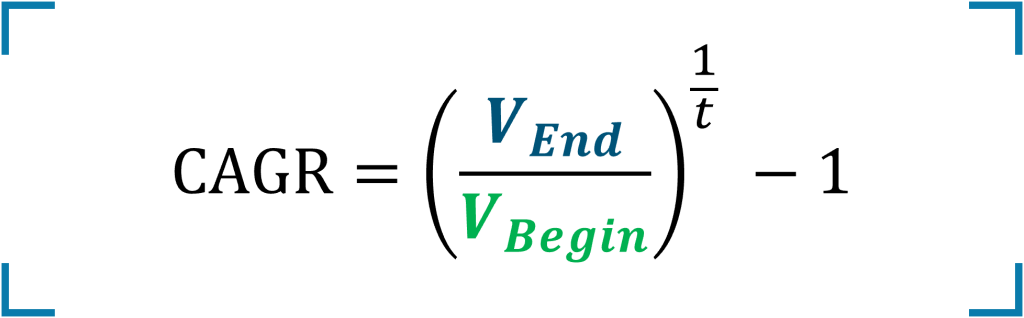

Next, divide the ending value by the beginning value, raise the result to the power of 1 over the number of years, and subtract one.

Example Calculation: CAGR of a Share Price

Assume a company’s share price on January 01, 2015, was $15. Seven years later, on January 01, 2022, the stock price has increased to $78.

That’s all the information needed to calculate the CAGR: