What is Accounts Receivable Turnover?

Accounts receivable turnover is a liquidity ratio that describes how efficient a company is at collecting accounts receivables from clients.

How to Calculate Accounts Receivable Turnover

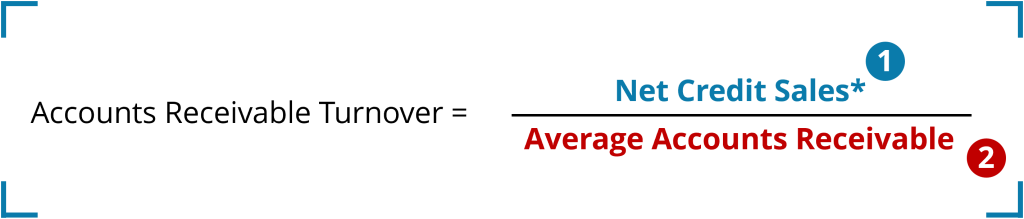

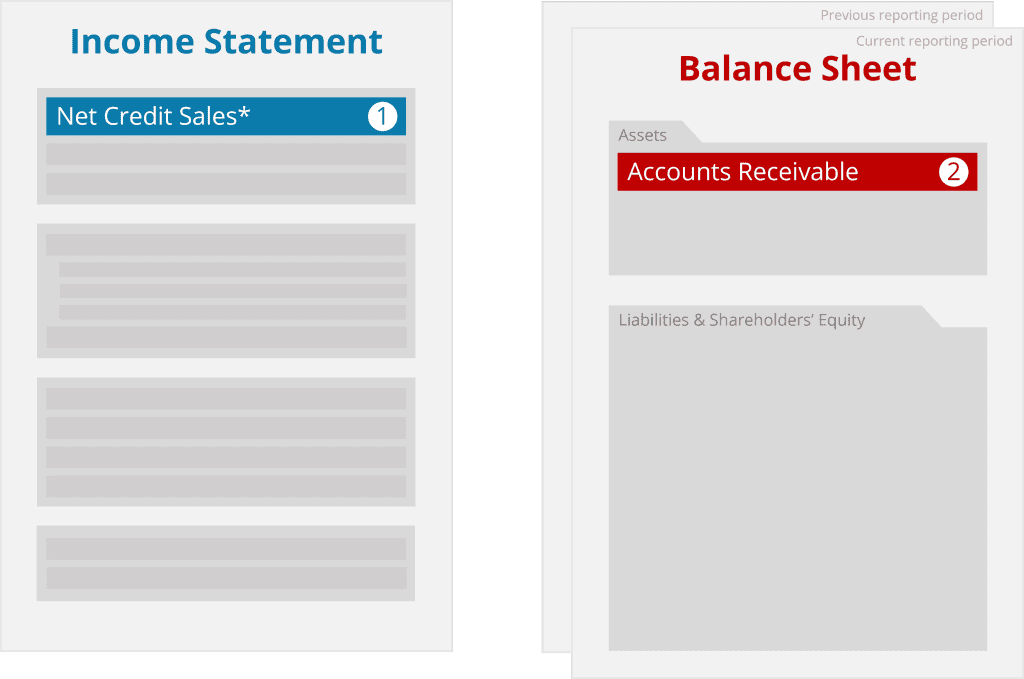

Accounts receivable turnover is calculated by dividing net credit sales by average accounts receivable.

Net credit sales are any sales made by allowing payment with credit, i.e., allowing payment at a future time point. In financial statements reported by companies, the percentage of sales made on credit vs. directly is difficult to find. However, keeping in mind that most business-to-business transactions happen on credit, we could substitute net credit sales by revenues, readily available on the income statement.

Average accounts receivable is calculated by averaging the accounts receivable numbers on the balance sheets of the current and previous reporting periods.

How to Interpret Accounts Receivable Turnover

Accounts receivable turnover is only relevant to look at for companies that allow payment for their products and services on credit, e.g., within 30 days, as this results in an accounts receivable entry on the balance sheet. This is typically the case for most business-to-business transactions.

On the other hand, for retail-oriented companies, consumers typically pay for products and services without extended credit, so no accounts receivables get recorded, and the accounts receivable turnover figure becomes less important, if not irrelevant.

In general, a higher accounts receivable turnover means more efficient cash management, since any money owed does not sit on the balance sheet as receivables, but gets converted into cash more quickly.