What is the Assets to Equity Ratio?

The assets to equity ratio is a solvency ratio that gives an idea about whether a company finances its assets and operations more by issuing debt or equity.

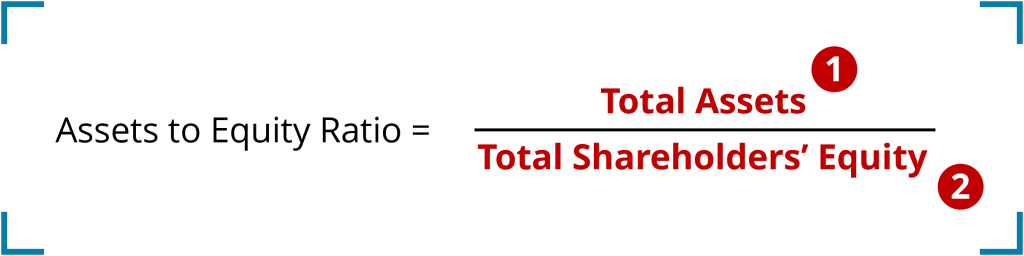

How to Calculate the Assets to Equity Ratio

The assets to equity ratio is calculated by dividing total assets by total shareholders’ equity, both found on a company’s balance sheet.

How to Interpret the Assets to Equity Ratio

To interpret the assets to equity ratio, it helps to remember the accounting equation:

Asset = Liabilities + Equity

The equation describes that a company’s assets are financed by liabilities and equity. The assets to equity ratio describes to what degree the assets are financed by liabilities, and to which degree by equity.

The higher the assets to equity ratio, the riskier a company becomes, since a larger portion of the assets is financed with debt.

An assets to equity ratio of 1 indicates that a company’s assets are fully financed by equity (total shareholders’ equity), and with no debt. This represents the least risky scenario. However, having no debt at all might not be ideal for a company that could take on moderate amounts of debt to finance projects and growth initiatives whose value upon completion exceed the cost of debt.

An asset to equity ratio of 2 represents a scenario of moderate debt levels.